matplotlibを用いて住民税を計算する#

住民税の計算方法#

合計所得金額-損失の繰越控除=総所得金額

総所得金額-所得控除額の合計=課税所得額

課税所得額×税率(10%)=税額控除前の所得割額

税額控除前の所得割額-税額控除の額=税額控除後の所得割額

税額控除後の所得割額+均等割額=住民税の額

参考

https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/1410.htm

https://www.oag-tax.co.jp/asset-campus-oag/inhabitant-tax-845#2-5STEP3

import numpy as np

import matplotlib.pyplot as plt

import japanize_matplotlib

1. 総所得金額を計算する#

損失の繰越控除は今回考慮しないものとする

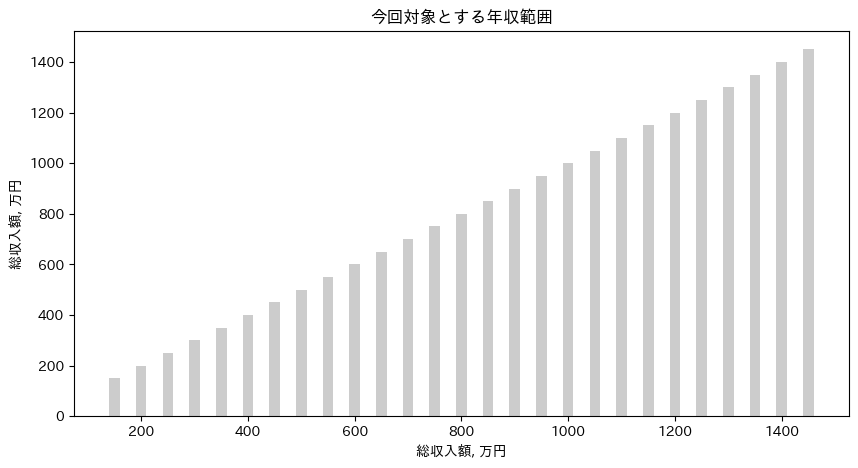

年収が150万円~1500万円までを計算範囲とする

income_whole = np.arange(150, 1500, 50)

fig, ax = plt.subplots(figsize=(10, 5))

plt.title('今回対象とする年収範囲')

ax.bar(income_whole, income_whole, width=20, alpha=0.4, color='gray')

ax.set_xlabel('総収入額, 万円')

ax.set_ylabel('総収入額, 万円')

plt.show()

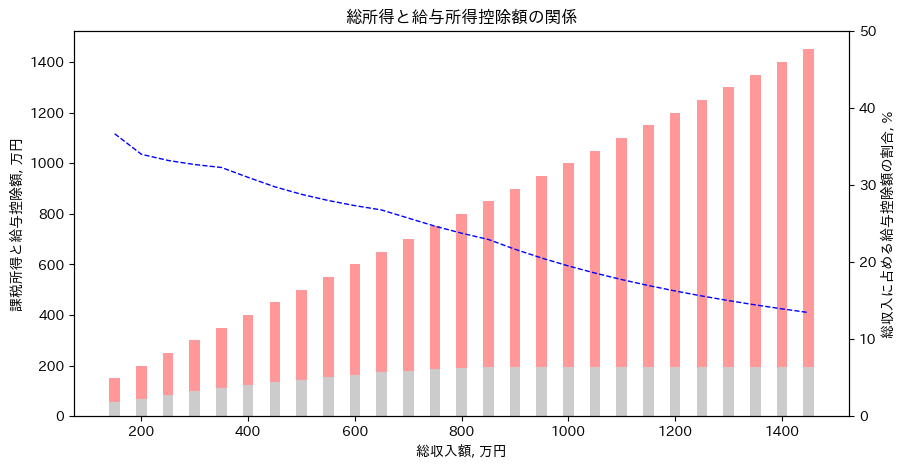

2. 課税所得額を計算する#

def 給与所得控除計算(income_whole: int):

'''

(参考):https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/1410.htm

*関数名を英語もしくはローマ字にすると可読性が悪くなると思いあえて感じにした

'''

if income_whole <= 162.5:

income_deduction = 55

elif income_whole <= 180:

income_deduction = income_whole * 0.40 - 10

elif income_whole <= 360:

income_deduction = income_whole * 0.30 + 8

elif income_whole <= 660:

income_deduction = income_whole * 0.20 + 44

elif income_whole <= 850:

income_deduction = income_whole * 0.10 + 110

else:

income_deduction = 195

return income_deduction

def 住民税計算(income_taxable: int):

'''

(参考):https://biz.moneyforward.com/tax_return/basic/49732

'''

# 所得割の標準税率は10%

resident_tax = income_taxable * 0.10

# 均等割(年額)の5000円分を加算

resident_tax += 0.5

return resident_tax

income_deduction = np.array([給与所得控除計算(i) for i in income_whole])

income_taxable = income_whole - income_deduction

income_deduction_rate = income_deduction / income_whole * 100

fig, ax = plt.subplots(figsize=(10, 5))

plt.title('総所得と給与所得控除額の関係')

ax.bar(income_whole, income_deduction, width=20, alpha=0.4, color='gray')

ax.bar(income_whole, income_taxable, bottom=income_deduction, width=20, alpha=0.4, color='r')

ax2 = ax.twinx()

ax2.plot(income_whole, income_deduction_rate, 'b--', linewidth=1)

ax.set_xlabel('総収入額, 万円')

ax.set_ylabel('課税所得と給与控除額, 万円')

ax2.set_ylabel('総収入に占める給与控除額の割合, %')

ax2.set_ylim([0, 50])

plt.show()

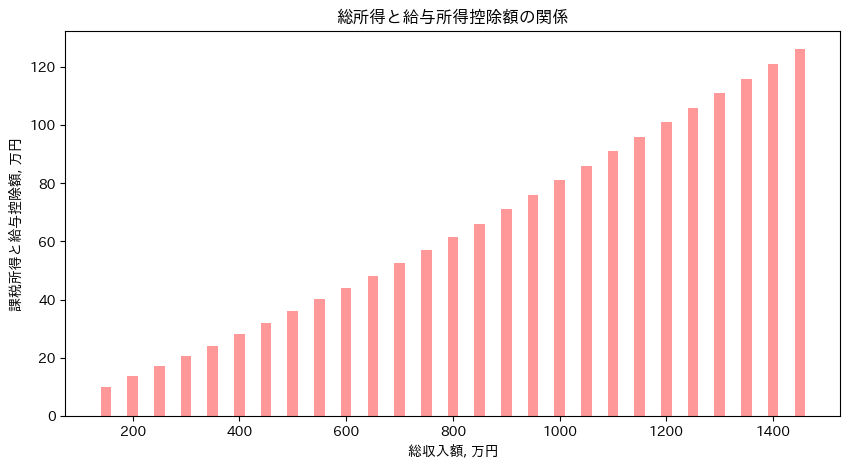

3.税額控除前の所得割額を計算する#

課税所得額×税率(10%)=税額控除前の所得割額

resident_tax = np.array([住民税計算(i) for i in income_taxable])

resident_tax_rate = resident_tax / income_whole * 100

fig, ax = plt.subplots(figsize=(10, 5))

plt.title('総所得と給与所得控除額の関係')

ax.bar(income_whole, resident_tax, width=20, alpha=0.4, color='r')

# ax2 = ax.twinx()

# ax2.plot(income_whole, resident_tax_rate, 'b--', linewidth=1)

ax.set_xlabel('総収入額, 万円')

ax.set_ylabel('課税所得と給与控除額, 万円')

# ax2.set_ylabel('総収入に占める給与控除額の割合, %')

# ax2.set_ylim([0, 50])

plt.show()

83354*12

1000248